Unknown Facts About Dental Debt Collection

Wiki Article

Some Known Factual Statements About Dental Debt Collection

Table of ContentsThe 3-Minute Rule for International Debt CollectionFascination About Private Schools Debt CollectionSome Known Details About Debt Collection Agency The Best Guide To International Debt Collection

A debt collection agency is an individual or organization that is in business of recouping cash owed on overdue accounts - Dental Debt Collection. Numerous financial obligation collection agencies are employed by firms to which cash is owed by people, running for a level cost or for a percentage of the quantity they are able to accumulateA financial obligation enthusiast attempts to recoup past-due financial obligations owed to financial institutions. Some financial debt collection agencies acquisition overdue financial obligations from lenders at a discount rate and then seek to accumulate on their very own.

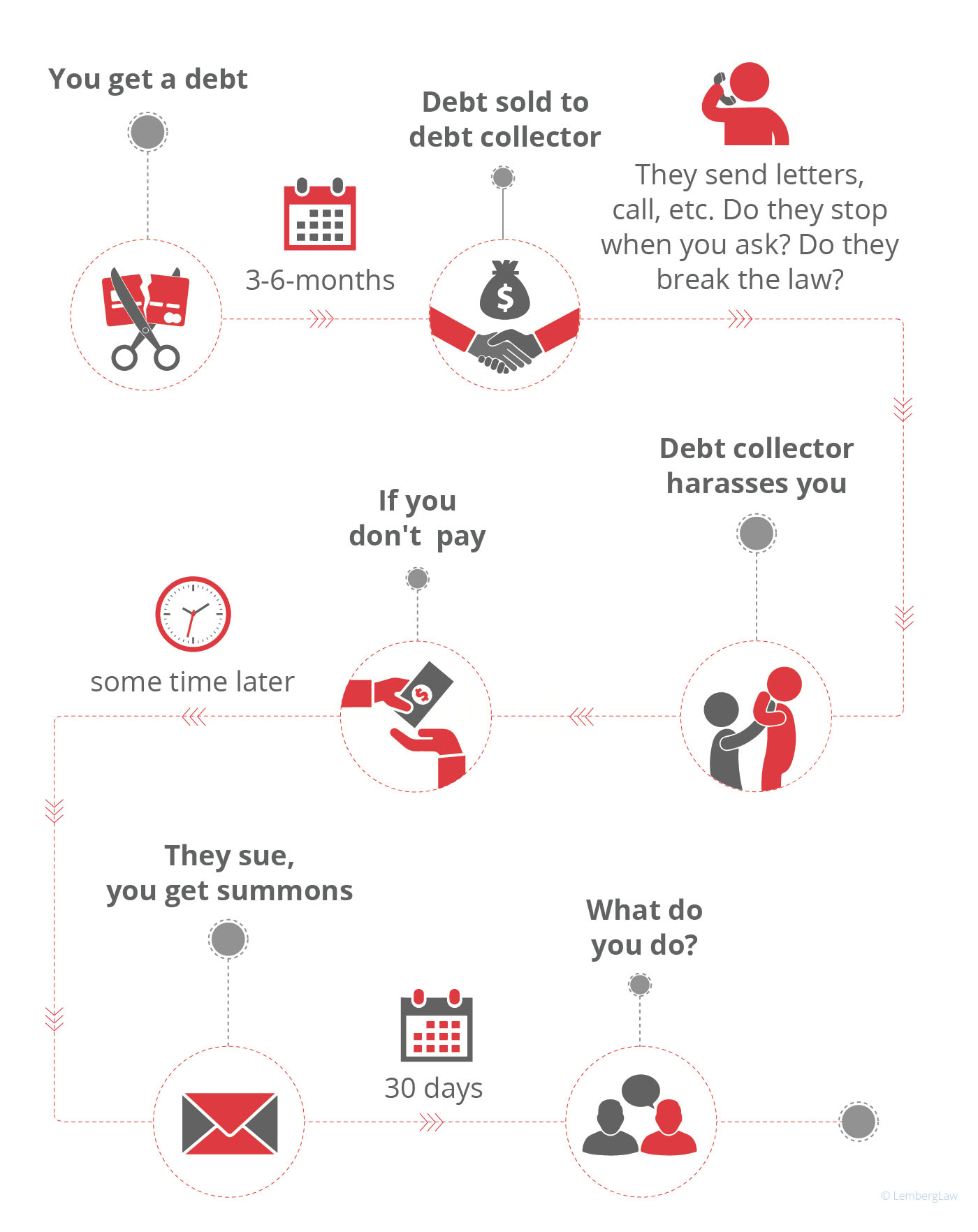

Financial debt collectors that violate the rules can be sued. When a debtor defaults on a financial debt (significance that they have actually stopped working to make one or more needed settlements), the loan provider or lender might transform their account over to a debt collection agency or debt collectors. At that factor the financial debt is claimed to have gone to collections.

Overdue settlements on credit history card balances, phone bills, auto lendings, utility expenses, as well as back tax obligations are examples of the delinquent financial debts that a collection agency may be charged with getting. Some business have their own debt collection divisions. The majority of discover it less complicated to work with a financial obligation enthusiast to go after unpaid financial debts than to chase the customers themselves.

Some Known Factual Statements About Dental Debt Collection

Debt collectors may call the individual's personal and also work phones, and also also turn up on their front door. They might additionally call their household, friends, and also next-door neighbors in order to validate the call info that they have on documents for the person. (Nevertheless, they are not allowed to disclose the reason they are attempting to reach them.) Furthermore, they might send by mail the debtor late payment notifications.m. or after 9 p. m. Neither can they falsely declare that a borrower will be apprehended if they fall short to pay. Furthermore, a collector can't physically injury or intimidate a borrower and also isn't enabled to take assets without the approval of a court. The legislation likewise gives debtors certain rights.

Both can continue sites to be on credit history reports for approximately 7 years and have an adverse impact on the person's credit report, a huge section of which is based upon their settlement background. No, the Fair Financial Debt Collection Practices Act uses only to consumer debts, such as mortgages, credit scores cards, vehicle loan, trainee fundings, as well as medical costs.

6 Easy Facts About Business Debt Collection Explained

When that takes place, the internal revenue service will send out the taxpayer an official notification called a CP40. Since frauds prevail, taxpayers must be cautious of any person claiming to be functioning on behalf of the IRS as well as consult the IRS to make sure. That relies on the state. Dental Debt Collection. Some states have licensing needs for debt collectors, while others do not.

A debt debt collector is a business that works as middlemen, gathering customers' overdue debtsdebts that go to the very least 60 days past dueand paying them to the original creditor. Financial obligation collection agencies typically help debt-collection firms, though some operate individually. Some are additionally lawyers. Learn more concerning exactly how financial obligation collection agenies and financial debt collectors work.

Financial obligation collectors get paid when they recoup delinquent financial obligation. Some debt collector bargain Our site settlements with consumers check these guys out for much less than the amount owed. Extra government, state, and also local rules were implemented in 2020 to shield consumers confronted with financial debt problems associated with the pandemic. Financial obligation collection firms will certainly pursue any kind of overdue financial obligation, from past due pupil loans to unpaid medical bills.

Some Known Facts About Dental Debt Collection.

A company could collect just overdue debts of at the very least $200 as well as less than two years old. A credible agency will certainly likewise restrict its job to gathering debts within the statute of limitations, which varies by state. Being within the law of limitations indicates that the debt is not as well old, and also the creditor can still seek it legitimately.A financial obligation enthusiast has to depend on the borrower to pay and also can not seize a paycheck or reach right into a checking account, even if the routing and also account numbers are knownunless a judgment is acquired. This implies the court orders a debtor to pay off a specific amount to a particular creditor.

Debt collectors additionally call overdue consumers that already have judgments versus them. Also when a creditor wins a judgment, it can be testing to accumulate the money.

When the initial lender figures out that it is unlikely to accumulate, it will certainly cut its losses by marketing that debt to a financial debt customer. Lenders bundle various accounts along with comparable functions as well as offer them as a group. Financial obligation buyers can pick from packages that: Are fairly brand-new, with no various other third-party collection task, Extremely old accounts that collection agencies have stopped working to collect on, Accounts that drop somewhere in between Financial debt buyers typically buy these packages with a bidding process, paying on ordinary 4 cents for every $1 of financial debt stated value.

Report this wiki page